2025 Annual Gift Exclusion Amount - Annual Gift Tax Exclusion 2025 Lisa Renelle, The 2025 lifetime gift limit is $13.61 million, up from $12.92 million in 2023. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts. The internal revenue service has published the 2025 estate and gift exemption amounts.

Annual Gift Tax Exclusion 2025 Lisa Renelle, The 2025 lifetime gift limit is $13.61 million, up from $12.92 million in 2023. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts.

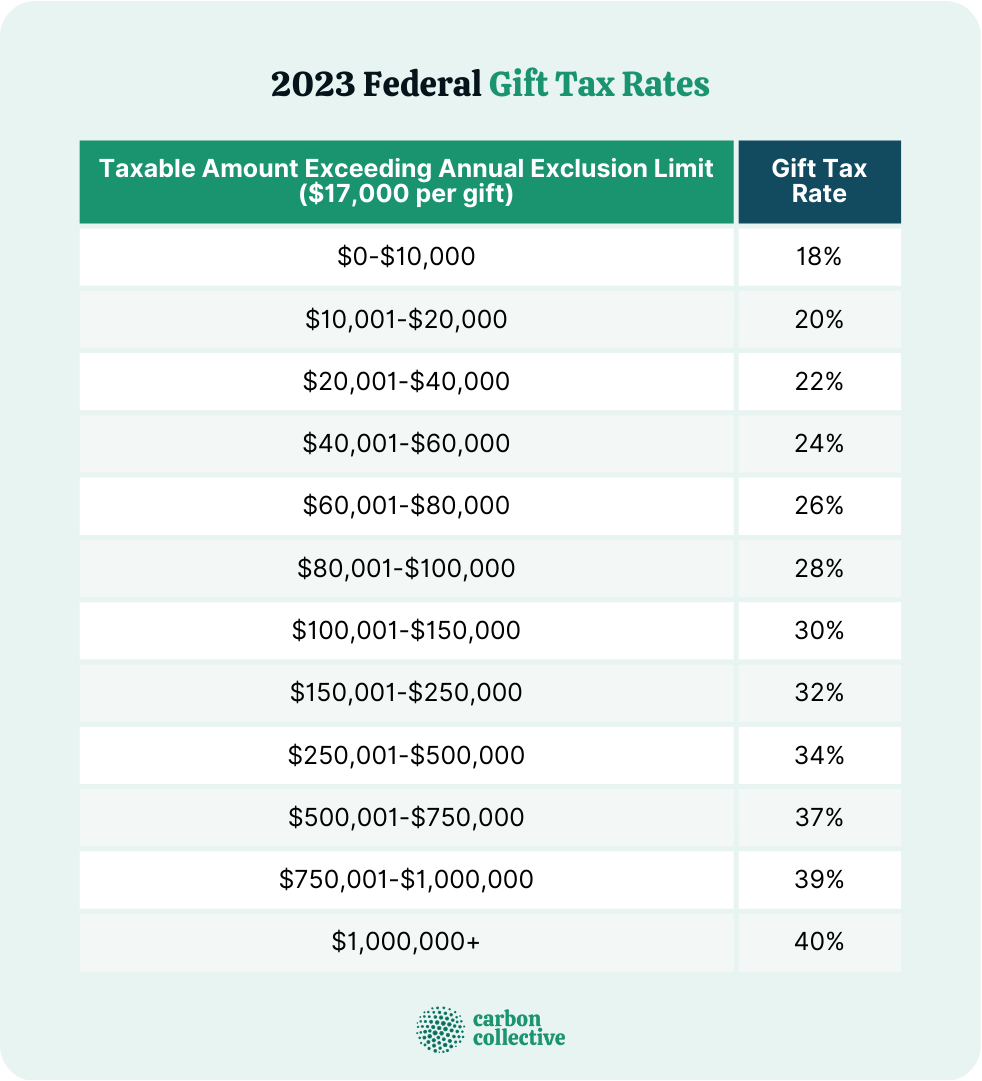

Annual Federal Gift Tax Exclusion 2025 Niki Teddie, For instance, if a father makes a gift of $118,000 to his. Instead, the amount of the gift over $18,000 may simply reduce the $13.61 million combined lifetime gift and federal estate tax exclusions.

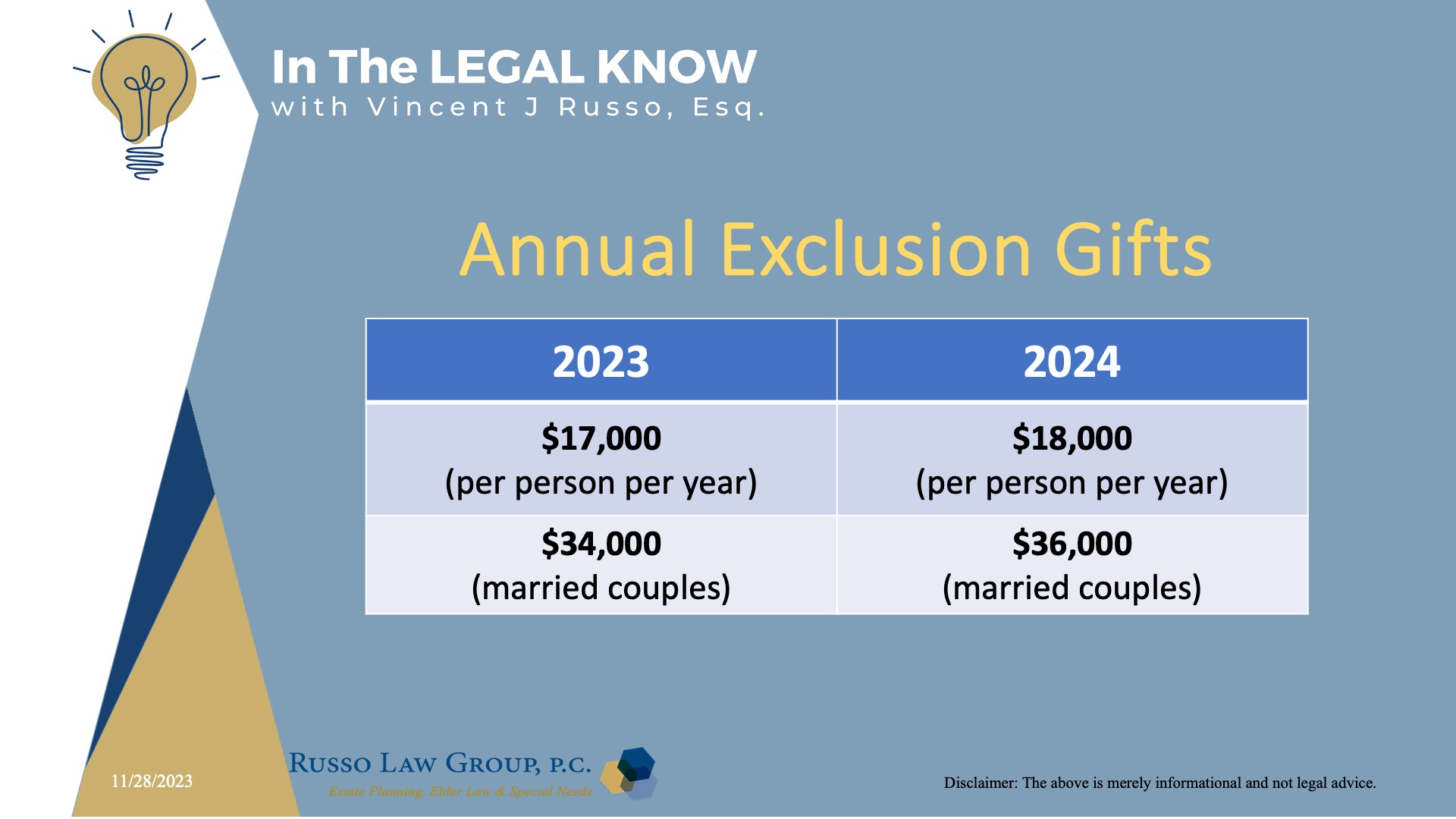

Annual Gift Tax Exclusion 2025 A Comprehensive Guide Books And, The 2025 annual exclusion amount will be $18,000 (up from $17,000 in 2023). The unified exclusion amount is $13,610,000 and the annual gift.

Annual Gift Amount 2025 Rania Catarina, If you gift more than that, you’ll need to file a federal gift tax. The exclusion will be $18,000 per recipient for 2025—the highest exclusion amount ever.

Gift Tax Annual Exclusion ppt download, For 2025, the annual gift tax limit is $18,000. The exclusion will be $18,000 per recipient for 2025—the highest exclusion amount ever.

Gift Taxes and Annual Exclusion Gifts Russo Law Group, Thanks to annual inflation adjustments by the internal revenue service, the annual gift tax exclusion has increased to $18,000. The annual exclusion for gifts increases to $18,000 for calendar year 2025, increased from $17,000 for calendar year 2023.

Federal and Washington Estate Tax Exemptions and the Annual Gift, The 2025 lifetime gift limit is $13.61 million, up from $12.92 million in 2023. The annual exclusion for gifts increases to $18,000 for calendar year 2025, increased from $17,000 for calendar year 2023.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, While most taxpayers will never make gifts over $18,000 per donee, even if one does make gifts that exceed the annual exclusion amount it may not necessarily. In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

Annual Gifting For 2025 Image to u, For instance, if a father makes a gift of $118,000 to his. For example, a man could.

In 2023, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025, estimated to be $19,000 in 2025).

2025 IRS Increases to Federal Transfer Tax Exemption and Annual, (that’s up $1,000 from last year’s limit since the gift tax is one of many tax amounts adjusted annually for. Federal gift tax exemption 2025.

The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any.